Budgets are fine things.

They can help set goals, limitations and create healthy habits.

Whenever I’m due for a relatively big change in my life — new income, new priorities, new costs or the like — I play with a wonderfully useful Budget Calculator from CNBC.

Suppose, you pulled in roughly $2,800 a month from independent contractor work — $700 weekly of income that doesn’t have taxes taken out from an employer and works out to be $36,400, a small fortune for some. A good rule of thumb is to put aside 30 percent of monthly income for taxes, so you don’t get yourself caught when paying quarterly or annual taxes.

$2,800 minus $840 (the 30 percent reserved for taxes) equals $1,960.

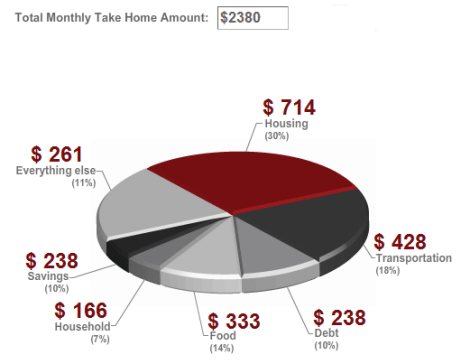

Now how do you break that down, according to the CNBC suggestions? See the graph and details below. (Above is the total for making $44,200, or $850 pre-tax weekly)

- Housing (30 percent) — $588 monthly for mortgage, taxes and insurance

- Transportation (18 percent) — $352 monthly for mass transit, bicycle repair and car gas and maintenance

- Debt (10 percent) — $196 monthly for student loans and credit card payment

- Food (14 percent) — $274 monthly for groceries, lunches and dinners out

- Household (7 percent)— $137 monthly for utilities, phone and cable bills

- Savings (10 percent) — $196 monthly for bank account liquidity and retirement fund

- Everything Else (11 percent) — $215 monthly for clothing, charity and other miscellaneous items.

Of course, this is just the take from one person, and there are certainly others that are even more involved.